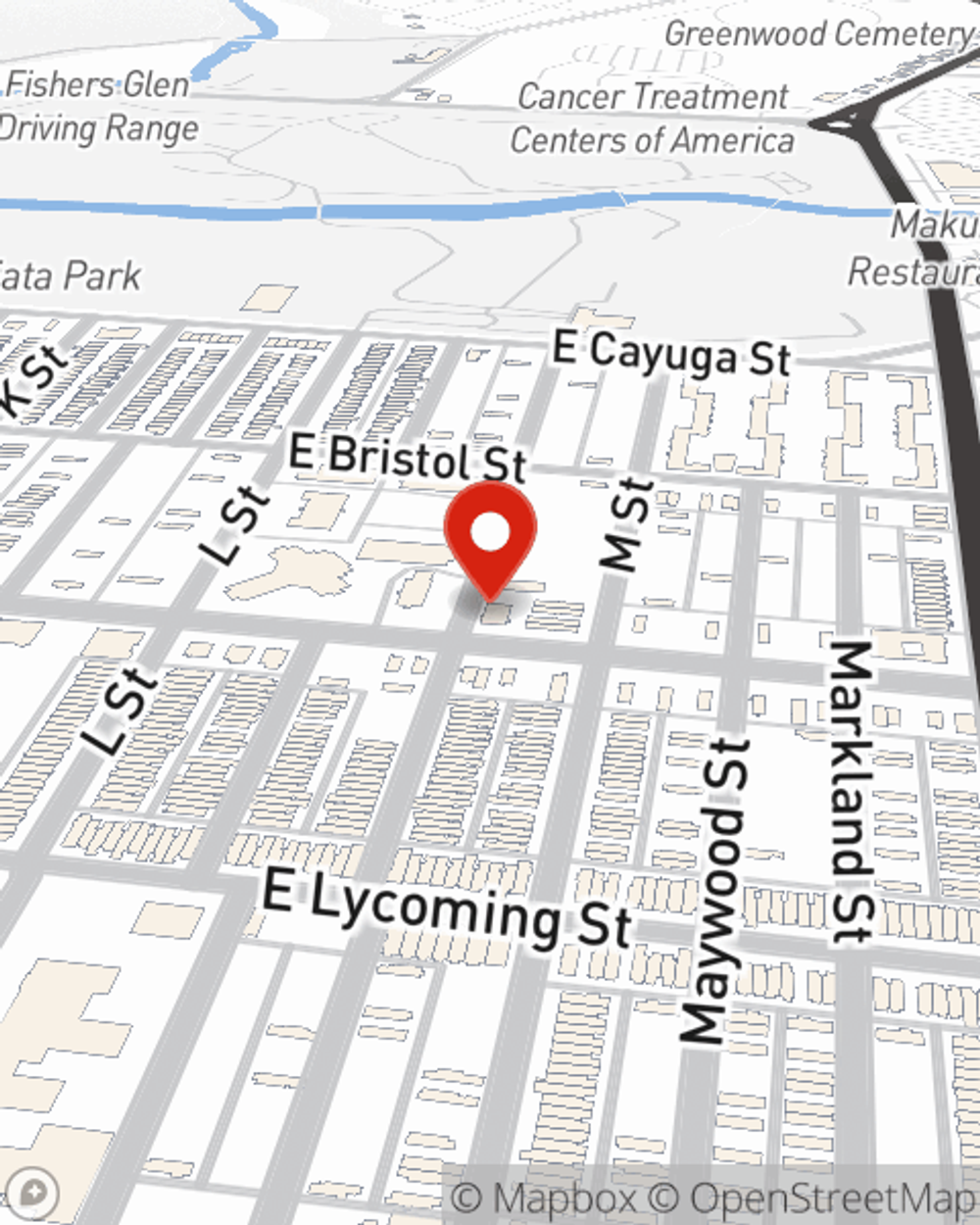

Business Insurance in and around Philadelphia

Looking for small business insurance coverage?

Helping insure small businesses since 1935

State Farm Understands Small Businesses.

Owning a business is about more than making a profit. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for everyone you care for. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with a surety or fidelity bond, worker's compensation for your employees and business continuity plans.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Small Business Insurance You Can Count On

At State Farm, apply for the outstanding coverage you may need for your business, whether it's a barber shop, a photography studio or an ice cream shop. Agent Kevin Lowber is also a business owner and understands your needs. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

Reach out agent Kevin Lowber to learn more about your small business coverage options today.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Kevin Lowber

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.